ILinc

The ILINC-LearnLinc-Mentergy Story [PowerPoint version]

by Jack M. Wilson

Introduction:

The founding, growth and eventual acquisition of

the ILINC Corporation is a typical small example of technological

entrepreneurship. ILINC

was founded in 1993 by a professor (the author) and two students,

Degerhan Usluel and Mark Bernstein, at

Rensselaer Polytechnic Institute.

Later the name was changed to LearnLinc to match the name of its

popular product and eventually LearnLinc entered a triple merger in

early 2000 with Gilat Communications and Allen Communications to form

the Mentergy Corporation (NASDAQ).

The Research:

It all began with an idea, and that idea eventually

became a research project.

In the late 80’s and early 90’s, My scientific colleagues

and I were working on the application of computing and communication

technologies to science and engineering education.

After producing several multimedia projects, I turned my

attention to the management of large quantities of educational materials

on networks. The early

focus was on the modularization of materials and the ability to store

and retrieve those modules in an object oriented fashion.

I had served as an IBM Consulting Scholar and was a frequent speaker at conferences on multimedia on networks. At one point I was invited to present my vision of the future of networked multimedia education to a group of executives that included several key executives from AT&T. That speech led to an invitation to Bell Laboratories to discuss potential cooperation and to present my vision to a broader and more technical audience.

Apparently the speech was a great hit with the audience, because the AT&T Executives asked me to create a prototype of the vision -in partial collaboration with scientists from Bell Laboratories. The negotiation of the contract for this work took longer than most since I felt I had a significant interest in the pre-existing intellectual property and also wanted to maintain the rights to derivative work from the earlier work. This required some careful legal negotiations. Eventually an agreement was reached which granted rights to AT&T for all software newly created for this project, but it protected the earlier work I had done and allowed me to make further developments based upon it. The contract was written as a contract with deliverables and due dates rather than as a ”best efforts” grant. The contract and deliverables caused several faculty members I invited to decline to participate because of the difficulty of working under the pressure of deadlines in an academic environment. Nevertheless, Rensselaer and I entered the contract with AT&T and began work on the project. The resulting prototype would allow distant learning on networks by using ISDN video conferencing and by using the same ISDN lines to network the distant learning sites. My team of students and staff and I also managed to make several of the pre-existing multimedia education projects work in this environment.

I was pressed into service for presentation after presentation to AT&T executives, engineers, and customers over the next few months. At the same time, the Bell laboratory engineers began to port the code into potential AT&T products including the WorldWorx project. Later the WorldWorx product was released in a global introduction, but (as we shall see) the product never caught on since the technologies were moving so quickly that it was out dated upon its release.

The Opportunity:

No technical person is ever satisfied with the

first version of any software product, and I was no exception.

So much had happened in computing and communications over the

course of the project and the ensuing months, that I became

convinced that it needed to be done quite differently in order to take

advantage in the advances in object communication and multicasting -just

to name two items.

I went back to my colleagues at AT&T and proposed that we start all over from scratch to create a different kind of prototype that would take advantage of all the new things. I was easily able to get the technical staff at Bell labs excited. They could see exactly what I was talking about, but the proposal went absolutely nowhere with the business units. They wanted to focus on getting out product, and (in their opinion) they had what they needed. The Rensselaer and Bell Laboratories technical staffs commiserated and schemed, but no further options presented themselves, and I moved on into other projects while continuing to work on the preliminary design - adding new features with each advance in computing.

One of the other projects in my laboratory, The Design and Manufacturing Learning Environment (DMLE), had a bright young graduate student, Degerhan Usluel, working on it, and he became fascinated with my plan for a network of educational objects -all communicating across the internet and distributing voice, video, and data to every site. Degerhan Usluel had been an undergraduate electrical engineering student who decided to come back for an MBA in entrepreneurship. As a student he had already founded one computing company that he turned over to his father before leaving for graduate school. Young, brilliant, naïve, and fearless, Degerhan was the ideal person for discussions about the future of collaboration on networks.

One day, Degerhan showed up in my office to announce that he was beginning to plan for his upcoming graduation and that he wanted to share that plan with me. He explained that he did not want to go to work for a large company and that he wanted to start a business in software and that he wanted to do that in collaboration with me. It came as a bit of a surprise when he told me that he wanted to start up his own company rather than go to work for one of the big companies recruiting him. When I asked him what kind of company he wanted to start he told me "Something in the computer and network field, but I am not sure exactly what, but I want you to be the President."

Moreover, he had recruited one of his classmates, Mark Bernstein to join him in the venture. Mark had been a “Top Gun” salesperson for Computer Associates prior to joining some friends in a start up computer disaster recovery firm called CPR. The firm had been a reasonable success, and Mark’s sales skills were certainly a factor.

After discussing several different possibilities, I pulled out a file that I had been keeping with the details of the design for a distributed learning environment that would run on the internet and utilize communicating objects on students and faculty machines in a peer – to peer architecture. I also pointed out that we could use multicasting to distribute the video and audio while using the multi-casting and agent technology to manage the bandwidth on the network. This was needed to keep bandwidth requirements from getting out of hand as more and more sites were added. I did not point out to Usluel that no one had really been able to make multicasting work reliably and that most of the Internet did not support it anyway. I was confident (foolishly) that these were all solvable problems. The fact that several major computing companies had tried and failed did not dissuade us.

I served as President and mentor while Usluel became Vice-President for Technology and Bernstein became Vice President for Sales, Marketing, and Business Development. I began serving as a part time President and full time Chairman of the Board using my 20% consulting time from Rensselaer, my weekends, my evenings, and my holidays. It was agreed upon up front that at the end of 1-1.5 years, I would either quit Rensselaer and join ILINC LearnLinc or step down as President and CEO, recruit a replacement and serve on the board. The decision would be a joint decision of the Founders.

Working with local attorneys, they created a Founder's agreement that granted 40% of the founder's stock to me and 30% each to Usluel and Bernstein. The agreement provided for potential future situations -such as a founder leaving. They also incorporated as the ILINC Corporation, obtained a Federal Tax ID, registered with the State, obtained the ILINC.com domain name, and opened bank accounts.

The Exit Agreement: Deciding what their exit strategy would be was one of the easiest tasks that they had to accomplish. It took about ten minutes to decide that all three founders wanted to create a successful public company, that would define a new category of software and change the world. They were not interested in creating a "lifestyle" or a "hobby" company, and did not think they wanted to keep it as a privately owned company. They wanted to build a company, go public or be acquired, and then go on to doing other things. If only the other tasks were as easy. Now they had to create a prototype, develop the pitch, and raise the money.

The Prototype: The prototype was created out of bits and pieces of my work augmented by some new materials prepared by both Wilson and Usluel. Bernstein worked on the pitch with lots of kibitzing from Wilson and Usluel.

Start-Up Funding -A Bootstrapping Process: Funding was a tougher problem. After discussion with a number of other successful entrepreneurs, such as William Mow, founder of Bugle boy industries and Mike Marvin, co-founder and Chairman of MapInfo corporation, Paul Severino , founder of Bay Networks, industry executives (especially from GE and IBM), and with lots of encouragement from Mark Rice, then Assistant Professor and Director of the Center for Technological Entrepreneurship, the founders decided to try to fund the company by bootstrapping the company through the sales of software for future delivery. With Wilson’s contacts and Bernstein’s passion and sales experience, they felt that they had a chance to do this without having to go to venture capitalists at an early stage. Wiser and more experienced executives (such as Warren Bruggeman, GE Executive and Chairman and primary investor in MapInfo) counseled them on the futility of this approach, but they decided to give it a try anyway.

Bernstein’s passion and Wilson’s persistence carried the day. They obtained enough contracts for future delivery of software to fund the company in the early days of growth. First customers included IBM, AT&T, GTE, Sprint, Office Depot, and Harper Collins Publishing (News Corp.).

An article in Success magazine later described our

improbable success story as a variation on the old story of Pop-eye the

Sailor Man’s friend Wimpy.

Wimpy would wonder around asking folks for hamburgers while

promising them that he would “gladly

pay you Tuesday for a hamburger today.”

In our case we promised that we would gladly give them software

next year for a $300,000 (give or take) payment today.

Although that does not sound like a compelling offer, we had many

takers. Early customers

included IBM, AT&T, GTE, Sprint, Office Depot, Aetna-United Healthcare, and

Harper Collins Publishing (News Corp.).

Mark Bernstein, Jack Wilson, and Degerhan Usluel accept one of the many awards given to ILinc LearnLinc

Building the Product: They were now to step eight of the entrepreneurship path. They had to do it. For that they turned to Usluel, because he had to build the product that I envisioned and Bernstein promised. And he did.

When the software was delivered, it managed to satisfy all but one of the early customers and eventually even that customer grudgingly conceded that ILINC LearnLinc had delivered what they had promised, if not quite exactly what the company wanted.

First Round of Venture Capital: ILINC then entered a rapid growth phase with very little working capital -depending upon cash flow to finance the each new step. When the monthly “burn rate” (the amount of cash spent each month) reached about $100,000 per month, the founders decided that it was finally time to visit the venture capitalists. Because the company had no track record, the founders were financing the shortfalls in the cash flow with bridge loans against receivables, but these had to be personally guaranteed by the founders. Signing monthly personal guarantees of $40,000 or so began to make them all a bit nervous, because none of them had the income to really handle this and only I had any assets!

They went to a local venture capital firm called Exponential Investors who helped to arrange several hundred thousand dollars of financing in cooperation with some New York State business development funds. It was also time for me to decide. My partners encouraged me to come in full time, but I decided that it would be better to go back to Rensselaer and recruit a more experienced CEO for the company. I felt that I would be able to continue to help with the vision and direction, but that the company would benefit from someone with past experience in creating new ventures. A new CEO, Jim O’Keefe, was recruited who had just completed another start-up that had been acquired.

The Next Two Rounds: The next few years saw ILINC grow substantially, if not painlessly, and two more rounds of financing in single digit millions brought investments from GeoCapital Investors and the Intel Corporation.

The multi-million dollar investment from Intel was one of the turning points for ILinc. Intel had a video card, the ProShare card, that could be inserted into micro-computers to allow one to play live video and do video conferencing. They also partnered with Microsoft to create a software/hardware solution for video-conferencing on networks. They were building servers that would receive the video streams from several computers in a conference setting and then compose that video and send it to all participants. The problem was the factorial increase in bandwidth as additional computers were added. (Bandwidth scaled as n! or n*(n-1)*(n-2)*(n-3)*(n-4)........). Thus if one went from two participants in conference to ten, the bandwidth scaled from 2x to 3,628,800x. This essentially made it impossible to serve more than a few computers in a conference. The ILinc architecture, which I had developed and Degerhan Usluel implemented and perfected, managed all this video bandwidth by keeping unused video off the network and introducing concepts now common in all conferencing systems -such as the ability to "Raise a hand" to request attention from the leader and the server.

Intel heard that ILinc had solved the scaling problem, but perhaps did not believe it fully. They sent a representative to our office for a confidential demonstration covered by non-disclosure agreements. I asked them how many simultaneous participants they were able to serve and they suggested that it was less than ten. At one point an Intel representative asked me how many simultaneous sites ILinc could link up with video, audio, and screen-sharing. Since we did not have the resources to equip many sites, we really did not know for certain. The mathematics told us that we should be able to do a very large number of sites, but we had not done it. The Intel representative then asked whether we could do more than 50 sites, and I said “sure.” Under my breath I added –“probably.” Intel then cobbled together a large number of sites which was less than the 50 but more than 20 and we were asked to do a demonstration. It worked. At that point Intel told us that they were willing to invest, but that we had to have a side-by-side venture capital partner that would make a matching investment –which we quickly (but not easily) accomplished.

We were also invited to develop a presentation for then CEO, Andy Grove, to do at a major software conference. According to many of my friends, Andy Grove was even more difficult and demanding to work with than Steve Jobs. Having worked with Jobs earlier in my career, I knew this was a high bar. They asked that I fly out to Santa Clara and meet with Grove to do a demonstration and answer his questions. I took the trip with some trepidation, but also knowing that the investment was already a done deal. His staff set me up in a demonstration room in which we had several computer simulating multiple remote locations. I was told that “Dr. Grove will come in at 11:15 am and then you will do the demonstration for precisely 15 minutes. At 11:30 he will begin to ask you questions. At 11:45 he will promptly depart for another meeting.” They sternly instructed me not to depart from the script and not to engage in small talk. The instructions were consistent with everything I expected.

Sure enough, at precisely 11:15 Andy Grove came in and introduced himself. We sat down together at a computer, and I began to demonstrate the product. I did not get too far until he asked his first question about our screen sharing protocol. Then he followed up by asking how we had been able to do so many simultaneous video sites when his folks only were able to do eight or so –and that took a big fast server to pull off! I explained that it was not really all that hard. We simply recognized that only two video streams at any time were necessary and we used agent technologies to shut off those streams that were not going to be used. We shut off those streams at the source, while standard multipoint video conferencing solutions dealt with them all at the video-conferencing server level. We set up a simple protocol of hand-raising that would allow any participant to ask for the floor –much as legislators ask for the floor in congress. That prompted another question and then another. 11:45 came and went but Andy Grove was still sitting at the computer asking me to demonstrate one point after another and firing off questions like he was giving a doctoral candidate an examination. That put him on my turf, and I was enjoying myself immensely. His staff got more and more nervous, but they were quite careful not to interrupt him. They kept giving me dirty looks, but Andy Grove just kept on asking questions and clicking on buttons. It was nearly 1 pm when he left with a smile and a big handshake. I could not have found him to be a nicer or more interesting guy.

When he delivered his speech, my partner Mark Bernstein was there to provide his support. It was one of the highpoints of our early years.

As noted above product development and financing went through several cycles as ILINC released new versions of LearnLinc and arranged new rounds of financing.

Fortune described ILINC as: “Interactive Learning International Corp. (ILINC), a two-year-old company in Troy, New York, has shown what's possible in today's world of limited telecommunications bandwidth. ILINC's interactive training programs can be transmitted to users' PCs over local- and wide-area networks, as well as high-speed communications links such as ISDN (integrated services digital networks). A live instructor can appear in a window on the screen and address students in dozens of locations. He can launch video and audio clips for all the "class" to see and hear. And at discussion time, a student can click on a "raise hand" icon to get the floor. “ -REPORTER ASSOCIATE Alicia Hills Moore Copyright © 1996, Time Inc., all rights reserved.

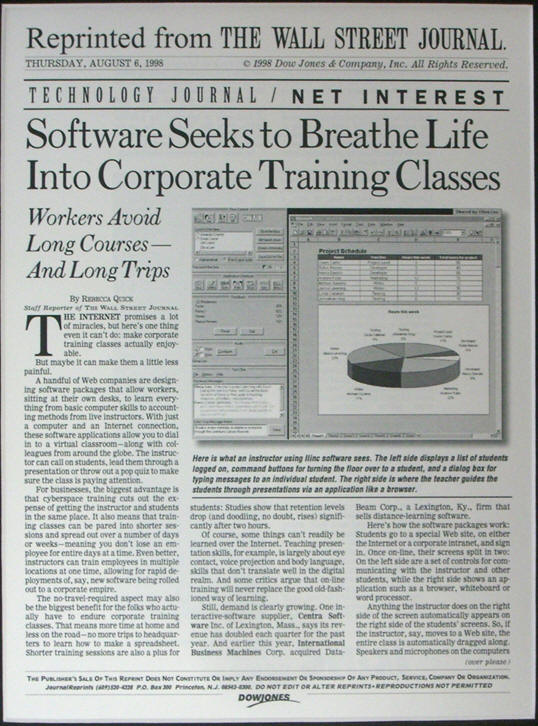

In 1998, the Wall Street Journal said: "'It's great -- by using it, we've cut our travel expenses substantially,' says Gary Schweikhart, a spokesman for Office Depot, an office-supply company in Delray Beach, Fla. Office Depot first took its corporate training sessions on-line in May 1996. It was one of the first customers of Interactive Learning International Inc., or ILINC, a Troy, N.Y., maker of distance-learning software. Since then, about 1,500 Office Depot employees have completed on-line training, on everything from how to write a business letter to how to use the company's proprietary order-taking system. 'We were in a situation where we were doing a lot of training of trainers' in order to have enough qualified instructors to teach employees at 629 stores and 68 sales offices across the country, says Doug Kendig, the company's manager of training technology. 'We had to deputize a lot of people [to train employees], and you don't always get the best results that way.' But now Office Depot uses the ILINC software for about 20% of its training, with classes in Florida, California and Texas using just six instructors. 'I think it's fantastic,' says Jeannette Perez, who works in Office Depot's commercial credit-card department. 'It just holds my attention more, because you're interacting with the computer.' -[Wall Street Journal –Thursday August 6, 1998 ]

Andy

Grove, CEO of Intel, and Mark Bernstein when Andy presented LearnLinc to

thousands of attendees at a major national convention after Intel

invested millions in ILinc and also adapted its software to some Intel

products.

Andy

Grove, CEO of Intel, and Mark Bernstein when Andy presented LearnLinc to

thousands of attendees at a major national convention after Intel

invested millions in ILinc and also adapted its software to some Intel

products.

The Plot Thickens: The company was becoming successful but experiencing growing pains and

pinched financing. Moreover, they now had some very significant

competitors. Without

patents on the underlying technology, the fast followers were able to

reverse engineer the LearnLinc product.

Although their earliest efforts were crude and unreliable, there

was no reason to believe that they would not get steadily more powerful.

These competitors were also much better funded.

ILinc was founded in 1993 by people who knew the “old rules” of

entrepreneurship. They

focused on revenues, tried to achieve positive cash flow, and minimized

the acquisition of venture capital.

Their competitors were living in a “new-new world:” the dot-com

era of the tech boom.

They raised ten times the venture capital and thus had a far more

powerful sales and marketing enterprise.

There were times that the LearnLinc product was only being discovered

after one of its competitors had gone into a company and sold them on

the concept. For big

companies like Aetna-United Health Care, there was a process to evaluate

competitors for big purchases.

After Centra had sold them a pilot, LearnLinc was chosen as the

corporate provider. In

general, it is difficult to rely on your competitors to sell your

product.

Going Public: By the summer of 1999, the founders felt that it was time for LearnLinc to raise much more funding and to grow substantially. The new CEO had been replaced by an interim CEO, Mike Marvin, and then by Degerhan Usluel. I continued to serve as Chairman. The Board decided to hire an investment banker (Michael Kane and Associates of California) and met with a selection of other entrepreneurs to decide how to best go forward. They identified three potential paths:

-

Do an IPO.

-

Get acquired by a complementary company

-

Enter a partnership with (and receive an investment from) a complementary company that would build upon their joint strengths and allow them to grow faster.

From the beginning, the group leaned toward some kind of business alliance or acquisition. Although the excitement and financial reward of the IPO was attractive, they felt that the glory might be short lived. They knew that LearnLinc needed a much larger sales force and needed to be much larger financially to crack the very large enterprise accounts that could allow them to reach the next level of development. Although they had sold product to IBM, AT&T, Lucent, MCI, Computer Associates, Aetna, United Health Care, Boeing, Flight Safety, and many other large accounts, these tended to top out at less than million dollar accounts. In order to grow and dominate the market, they needed to be able to crack that barrier. An IPO could bring them the funds necessary to grow, but it would take time and management attention to hire the people and create the systems needed to handle the growth.

The company’s advisors suggested that an IPO would likely value the company at $100 million to $200 million. Perhaps it could be more, but that would depend upon timing and market excitement. They also suggested that an acquisition would probably only bring about $50 million, but that the acquisition might leave the company better positioned to grow over the coming years. Given the anticipated lock-up periods for founders stock, the founders tried to evaluate the options as they would look one year into the future, rather than at the transaction date.

The Triple Merger - LearnLinc becomes Mentergy: Eventually we decided to agree to be acquired by Gilat Communications. The deal closed on February 29, 2000. Gilat paid 1.5 million shares (gross before commissions) for LearnLinc. On February 29, Gilat closed at $35 per share making the value of the deal $ 52.5 million at closing. Because of the use of bootstrap start-up funding, venture capitalists held less than 50% of the company at the close.

During the same period, Gilat acquired Allen Communications from the Times Mirror group for $23 million in cash. Over the next six months, the three companies were blended into one company - known as Mentergy. The companies had a complementary set of strengths. LearnLinc was the market leader in live-on-line eLearning. Allen Communications had an impressive established customer base, a large skilled sales force and specialized in web and CD-ROM based CBT. Gilat brought expertise in satellite communications and interactive learning over satellites. The plan was to create a blended learning approach that was “technology agnostic” and could provide the best eLearning solutions for a variety of different learning needs. The target market continued to be corporations and corporate training.

At first the market loved the combination. By March of 2000, Mentergy had a market capitalization of over $500 million. Plans were developed for a secondary offering both to cover the expenses of the triple merger and to provide additional development and marketing resources, but the declining stock market made that a difficult task. The situation was complicated further by a misguided effort to create a headquarters for Mentergy in Atlanta, Georgia (when most of the employees were in New York, Utah, and Israel) and by management confusion caused by the difficult communication process with key management personnel and the Board Chair in Israel. Wilson, Usluel, and Bernstein had agreed to remain involved for at least six months after the merger. I severed my ties in frustration as soon as allowable. Usluel and Bernstein persisted longer in a futile attempt to get the company back on track. By 2002, Mentergy was in bankruptcy.

The company was broken back into several pieces. The ILinc portion was purchased by EDT Learning from Arizona. They renamed themselves ILinc in honor of their successful product, which continues to be used in many major American corporations.

In hindsight, there would be many things that might be done differently

if we had to do them over again, but I hope that the reader can see how

we were thinking as we made each decision.

Questions for the student on opportunity recognition:

1. A new venture is expected to be attractive, timely, durable, and anchored in a product or service that creates or adds value for the buyer. How did ILINC fit with this description?

2. What was the "opportunity gap" that ILINC addressed.

3. Was ILINC a disruptive innovation? What did it disrupt?

4. How did ILINC fit with trends in economic forces, social forces, technological advances, and political and regulatory changes?

5. How did the personal characteristics of the entrepreneurs help and hurt?

Questions for the student on the positioning and type of the innovation:

1. Where would you place LearnLinc on the spectrum of types of innovations? Product or process; radical or incremental; architectural or component, competence enhancing or destroying?

2. How would you place LearnLinc on the S curve of technology? What does this imply for its adoption?

3. LearnLinc offered a low cost universal way to bring learning to learners in a corporate training environment. Were they operating in segment zero? If so, what was the market they were disrupting?

4. If you were advising ILINC as to how to manage its LearnLinc product just prior to its acquisition, what would you identify as major challenges they would need to face quickly?

Questions for the student on the protection of intellectual property

1. Why is it that the founders decided not to patent the product?

2. What were the obstacles to patenting the software?

3. What other forms of intellectual property protection might have been available to the founders, and what do you see as the advantages and disadvantages of each?

4. What was the consequence of not doing the patent?

5. If you were one of the founders, would you have pursued a patent?

6. Do you see any other strategies that they might have used?

Questions for the student on the exit strategy

1. What were the apparent advantages to doing an IPO?

2. What were the advantages to being acquired instead.

3. What drove the founders to consider these two alternatives instead of continuing organic growth?

4. If you were the founder, what strategy would you have selected and why?